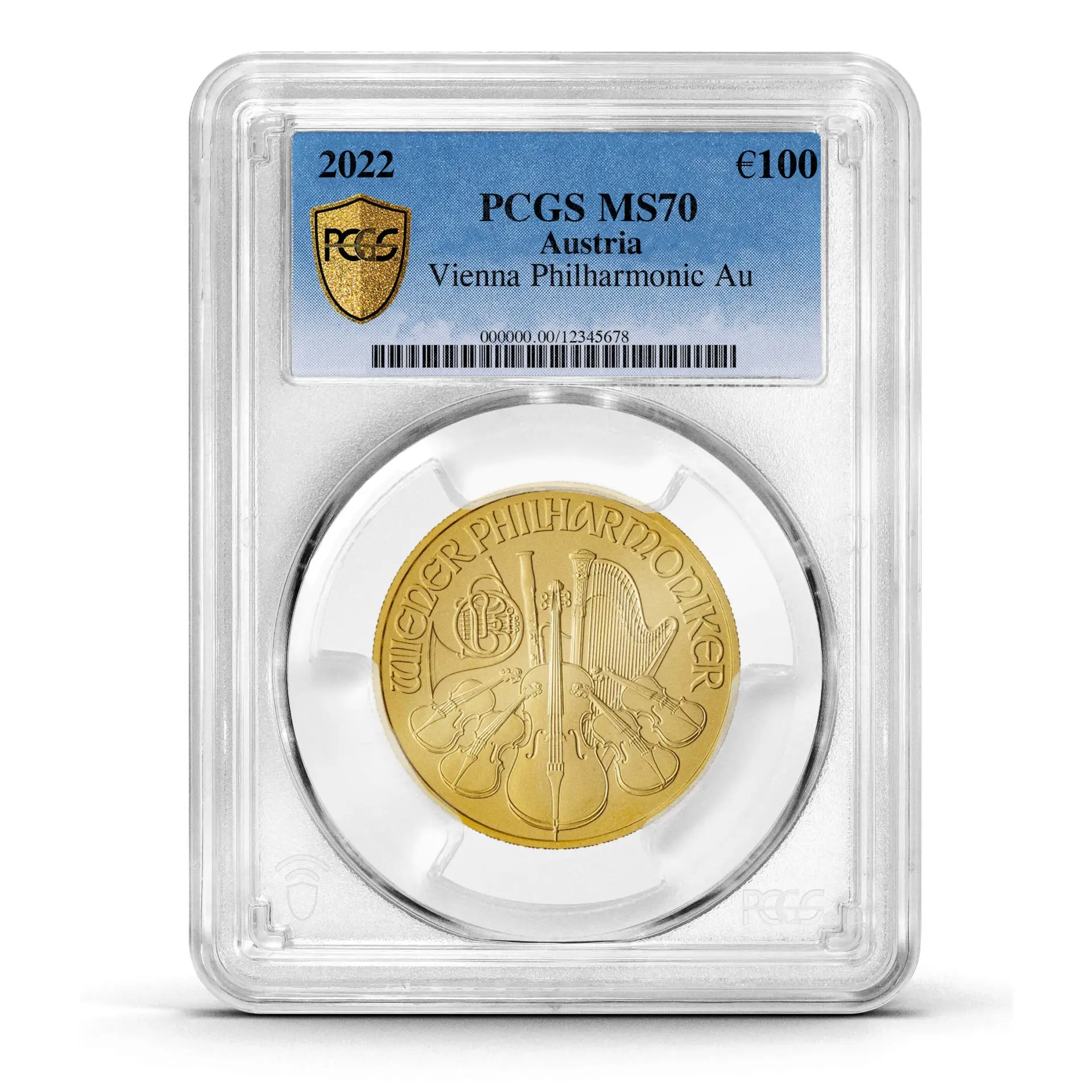

Coin Weight: 1oz

Gold Purity: 999.9

Brand: Austrian Mint

Country:Austria

The upcoming year of issue (2022) of the 1 oz Gold Philharmonic coin is now available. This coin is in brand new condition, without any sign of circulation.

Brand New Gold Coin

Brilliant Uncirculated

This coin is also known as the “Vienna Philharmonic”. It is the only European bullion coin with a unique flat shape (37.00 mm diameter, 2.00mm thickness). It is also the only european bullion coin with a face value in euros

Its name derived from the world renowned Vienna Philharmonic orchestra, central focus of design on both sides of the coin.

Solomon Global also offers:

a wide range of 1 ounce gold bullion coins at low premium.

Vienna Philharmonic Silver Coin.

Why buy Austrian Philharmonic gold coins ?

The Austrian Philharmonic is one of the most successful gold bullion coin issued in the European Union Since 1989. Not only in Europe, it is a world-renowned bullion coin generally purchased for investment.

The Austrian Mint issued for circulation worldwide more gold coins than any other mint in Europe. In 1992, 1995 and 1996, the Vienna Philharmonic was the world’s best selling gold bullion coin. Its high success in the international market makes it a an item with a solid investment value.

Highest purity : The Vienna Philharmonic coins is the only 24 carats (999.9 fine gold) gold bullion coin from Europe, bought and sold with the lower premium above the gold price.

Throughout most of Europe, this gold bullion coin is VAT free, and production varies annually depending on demand. The Austrian Philharmonic gold coin is legal tender in Austria, according to the Currency Act 1988. Buy Vienna Philharmonic gold coin is an excellent choice for European investors, mostly because of its high liquidity in Europe.

Why buy 1 oz gold coins ?

One ounce gold coins are popular in the gold bullion market. They are a great way to split your precious metal holdings in smaller fractions. In fact, a large gold bar is not always the best option. Even if you will pay less per gram with gold bars, a large gold bar will restrict the fungibility of your investment. Buying 1 ounce gold bullion coins make your investment more divisible and liquid. In fact, you can trade few gold coins when you need cash, instead of selling a whole bar at once. On the other hand, a large gold bar will be more difficult to convert into cash. Therefore, it is worth paying a slightly higher premium above the gold spot spot price.