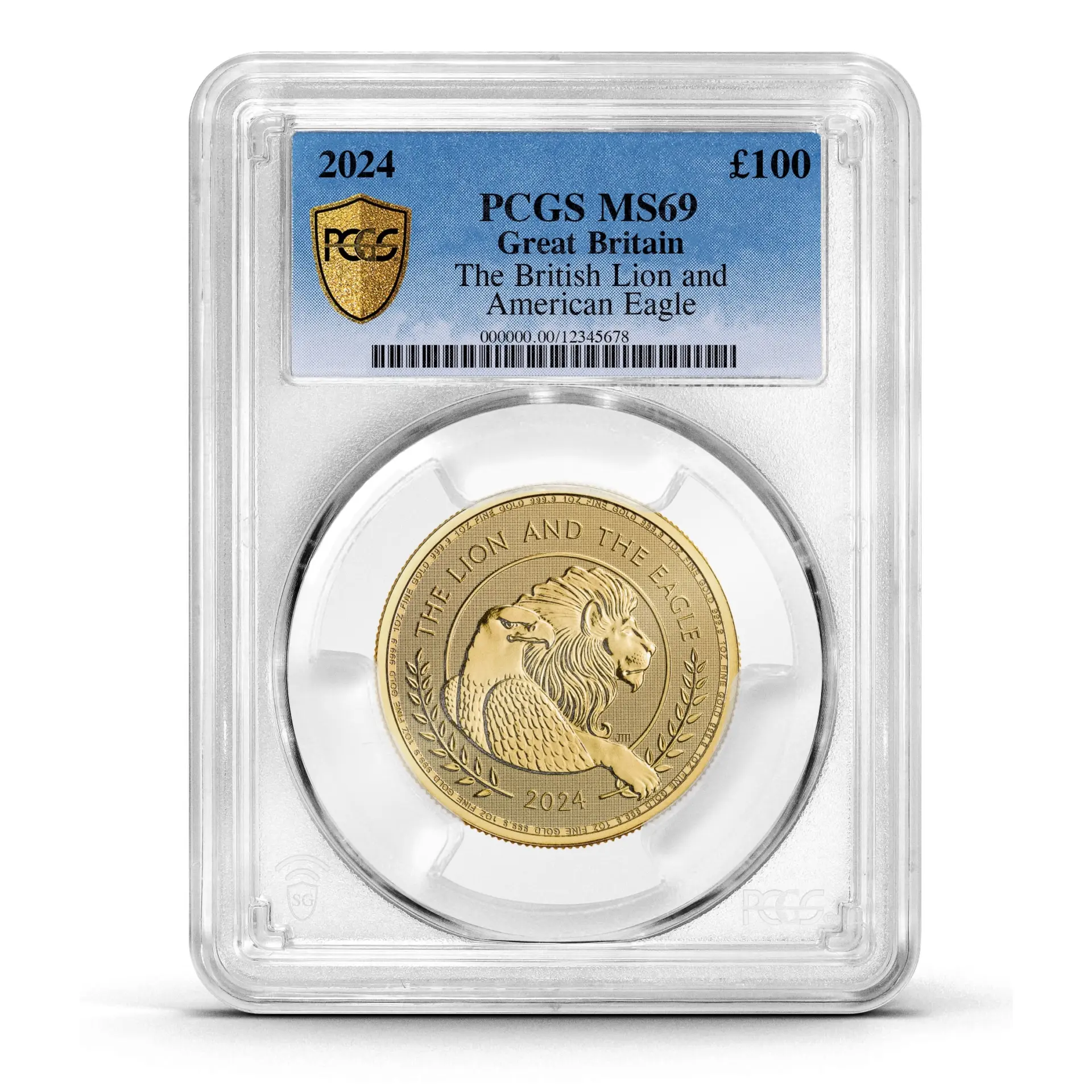

Coin Weight: 1oz

Gold Purity: 999.9

Brand: The Royal Mint

Country: United Kingdom

PCGS Mint State: MS 69

CGT Free: Yes

Order your brand new Graded 2024 Lion and Eagle 1oz Gold Coin today!

The Royal Mint unveils a magnificent symbol of unity with the Lion and Eagle 1oz gold bullion coin. Born from a collaboration with celebrated former US Mint Chief Engraver John M. Mercanti, unites two potent emblems: the steadfast British Lion and the majestic American Eagle.

Why buy a 2024 gold Lion and Eagle?

These iconic figures, embodying courage, strength, and freedom, underscore the shared values and enduring bond between nations with an intertwined history. Crafted in 999.9 fine gold, this coin is not only a breath taking commemoration but also a wise addition to your precious metals portfolio.

They offer a great benefit to British investors. They are exempt from Capital Gain Tax in the UK. The weight, purity and gold content of the 2024 gold Britannia is backed by the Royal Mint.

Finally, buying gold Lion and Eagle coins offer several advantages compared to gold bars, and is a great choice for any precious metal investor.

They enable you to split your precious metal portfolio into smaller units of 1 ounce of gold.

They are highly liquid and have a low premium over the gold spot price.

Their fine gold content of 1 troy ounce (31.1035 grams) enables you to track their price easily. Since the gold price is also quoted in ounces, you just need to look at the live gold price available on our website to know the exact value of your gold Liberty and Britannia.

Why buy 1 oz gold coins?

Similar to other gold coins, 1 oz gold Britannia coins are exempt from VAT in the United Kingdom and all other EU member states.

They are an excellent method for dividing your precious metal holdings into smaller portions. In actuality, a large gold bar is not always the optimal choice. Even if you purchase gold bars at a lower price per gram, a large gold bar will limit the liquidity of your investment.

Purchasing 1-ounce gold bullion coins increases the divisibility and liquidity of your investment. Instead of selling an entire gold bar when you need cash, you can sell a few gold coins. Consequently, it is worthwhile to pay a slightly higher premium.